are funeral expenses tax deductible in 2020

That depends on who received the death benefit. No never can funeral expenses be claimed on taxes as a deduction.

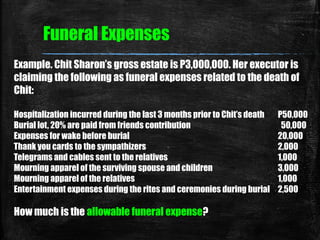

03 Chapter 4 Deductions From Gross Estate Part 01

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

. Funeral and burial expenses are only tax-deductible when paid by the decedents estate and the. The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses. Funeral expenses arent tax deductible for individuals and theyre only tax exempt for some estates.

The personal representative may file an amended return Form 1040-X for 2020 claiming the 500 medical expense as a deduction subject to the 75 limit. As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductible. These expenses may include.

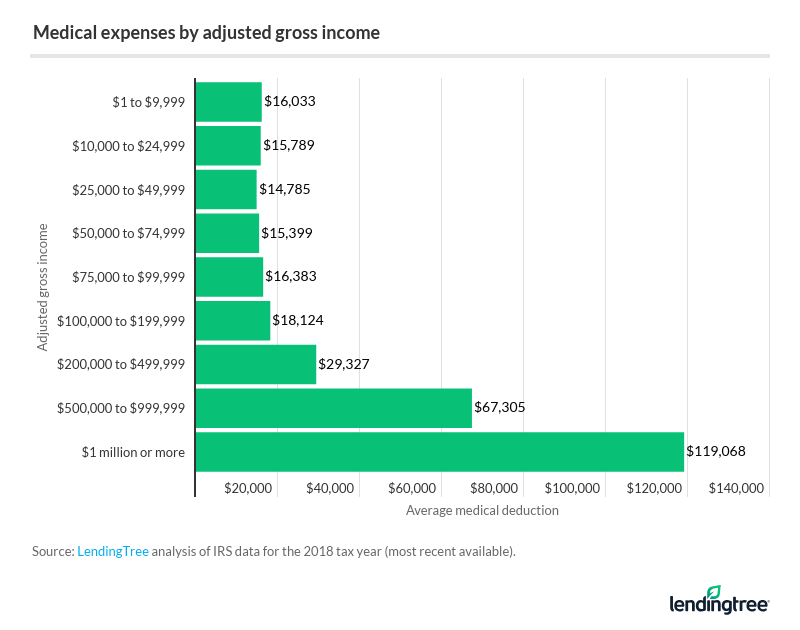

IRS rules dictate that all estates worth more than 1158 million in the 2020 tax year are required to pay federal taxes at which point they can take advantage of tax deductions on the funeral expenses of a loved one. Individual taxpayers cannot deduct funeral expenses on their tax return. Qualified medical expenses include.

However only estates worth over 1206 million are eligible for these tax. If an insurance policy covered the costs then. There is no requirement for the deceased.

Funeral expenses when paid by the decedents estate may be taken as a deduction on a. This is due within nine months of the deceased persons. The IRS allows deductions for medical expenses to.

These need to be an itemized list so be sure to track all expenses. Can funeral expenses for my mother who was 96 years young and on Medicare and Medicaid such as pre-plan funeral costs and a monument be deducted on my 2020 taxes. Up to 10000 of the total of all death benefits paid other than.

WASHINGTON The Internal Revenue Service today issued final regulations that provide guidance for decedents estates and non-grantor. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. Qualified medical expenses must be used to prevent or treat a medical illness or condition.

For most individuals this. According to Internal Revenue Service guidelines funeral expenses are not deductible on any individual tax return including the decedents final return. Individuals cannot deduct funeral expenses on their income tax returns.

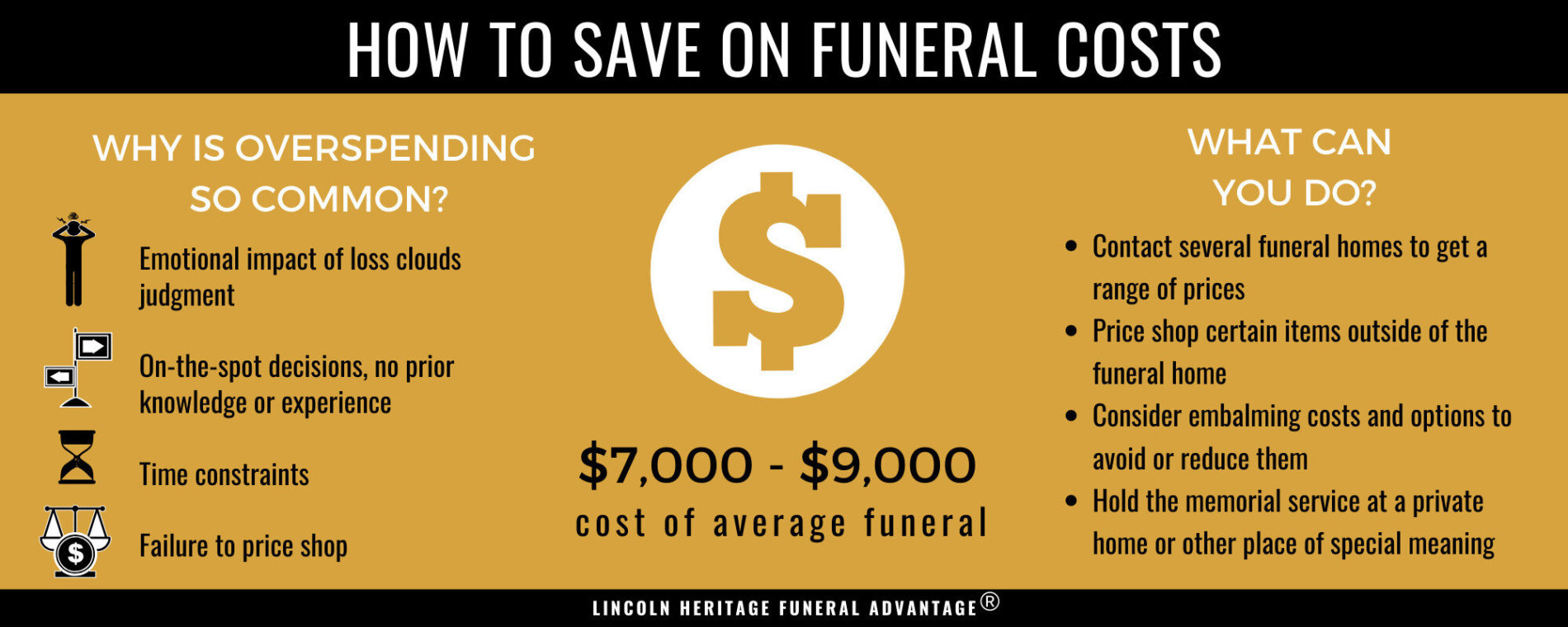

The applicant must be a US citizen noncitizen national or qualified alien who incurred funeral expenses after Jan. You may not deduct funeral expenses on your individual tax returns but there is a way you can save on funeral costs in todays economy. In short these expenses are not eligible to be claimed on a 1040 tax.

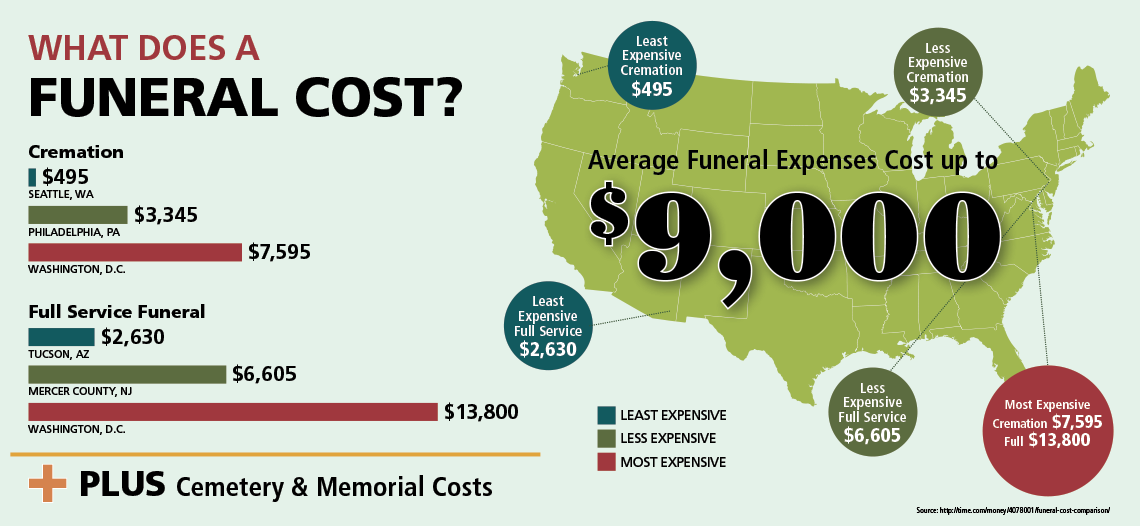

If someone takes a flight then the amount of money paid for the tickets cannot be written off because travel expenses are not tax-deductible. Estates worth 1158 million or more need to file federal tax returns and only 13. Funeral expenses are not tax-deductible.

Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs. According to the IRS funeral expenses including cremation may be tax deductible if they are covered by the deceased persons estate. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate.

While the IRS allows deductions for medical expenses funeral costs are not included. Deductible medical expenses may include but are not limited to the following. You may not take funeral expenses as a deduction on a personal income tax return.

In short these expenses are not eligible to be claimed on a 1040 tax. Funeral expenses are not tax deductible because they are not qualified medical expenses. Schedule J of this form is for funeral expenses.

The IRS deducts qualified medical expenses. The 300 of expenses incurred. IR-2020-217 September 21 2020.

A death benefit is income of either the estate or the beneficiary who receives it. In other words funeral expenses are tax deductible if they are.

Are Funeral Expenses Tax Deductible It Depends

Are Funeral Expenses Tax Deductible

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

03 Chapter 4 Deductions From Gross Estate Part 01

Are Funeral Expenses Tax Deductible It Depends

Tax Deductions In Italy Financial Advice In Rome Italy

Are Funeral Expenses Tax Deductible It Depends

Are Funeral Expenses Tax Deductible It Depends

Taxpayers Claim Nearly 17 000 Per Year In Medical Expenses

03 Chapter 4 Deductions From Gross Estate Part 01

How To Handle Medical Expenses Including Marijuana On Your Tax Return Oregonlive Com

Are Funeral Expenses Tax Deductible It Depends

Are Funeral Expenses Deductible The Official Blog Of Taxslayer